Profitable & Healthy Farm Businesses

Your source for research-based, culturally responsive educational programs, information and tools that inform farm business management decisions.

Topics

Find information to help you successfully mange your farm

Farm Pulse: Crop Insurance and Grain Marketing

An online course for farmers interested in learning the importance of risk management, crop insurance, and grain marketing

Featured Programs

Wisconsin Beginning Farmer Resource Guide

Designed as a road map, this guide walks beginning farmers through a variety of resources available to support them through their journey of starting an agriculture operation, farm, or food business. Print copies are available at your local USDA service center.

Latest News

Latest Articles

Terminating a farmland lease or tenancy

It is important to consider how and when a farmland lease may end. State law provides default rules for termination in the event that a landlord and tenant fail to discuss and document this topic.

Negotiating the Farmland Lease

Like any contract, a lease is a package deal. Landlords and tenants should carefully consider all of the terms offered by the other party before making a decision.

Is my Wisconsin farm lease enforceable?

Under Wisconsin law, a “lease” means an agreement, whether oral or written, for transfer of possession of real property, or both real and personal property, for a definite period of time. These leases are also a type of contract, so principles of contract law apply too.

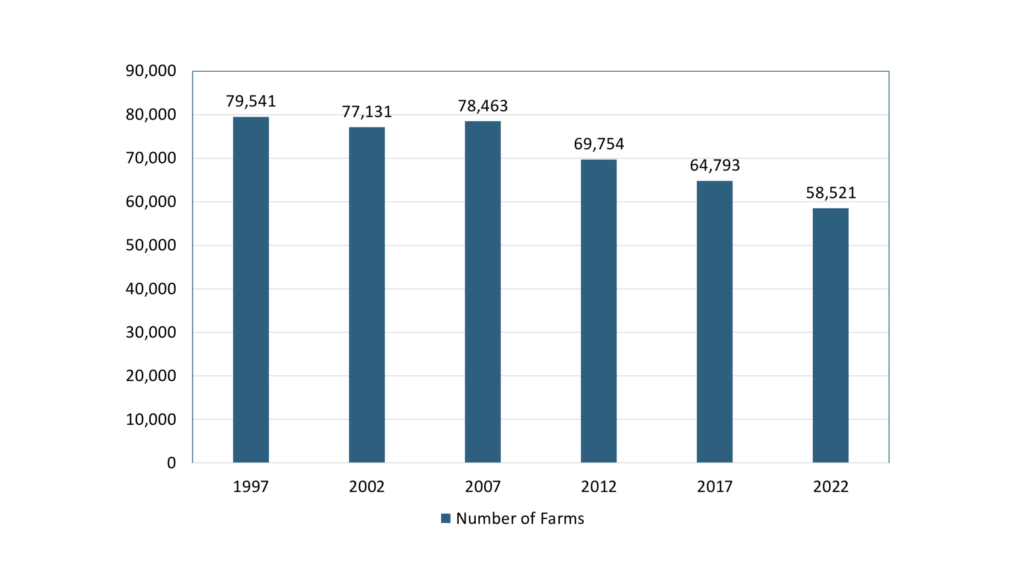

Wisconsin Farming: Insights from the 2022 Census of Agriculture

Every five years the USDA undertakes a detailed inventory of farming operations across the country. The most recent 2022 Census of Agriculture provides a snapshot of the nation’s farming economy, including demographics, production practices, land use, and economic trends.

Events

Stay Up to Date with Us

Subscribe to Our Newsletter

We share our newsletter four to five times a year.

Sign up to receive updates in your inbox!

Who are we?

The Extension Farm Management Program partners with the agriculture community to develop research-based, culturally responsive educational information, resources and tools that inform decisions for profitable, healthy farm businesses.

Contact our Extension Farm Management team at farms@extension.wisc.edu