Our programs effectively support people in Wisconsin with important financial decisions. For example, the great majority of participants (87%, RRFF) learned to track their income and expenses, and the vast majority (78% Rent Smart) reported that it will help them obtain appropriate housing. Our programs also effectively support frontline workers. For example, 92% (EFC) of frontline workers felt more prepared to discuss financial topics with clients.

Wisconsin faces significant economic racial inequities, ranking last among the 50 states in racial equality across 21 metrics. Despite efforts, there has been little progress in closing the wealth gap between white households and households of color. In 2023, poverty rates remained disproportionately high among Black, Native American, Latino, and Asian residents compared to their white counterparts. Homeownership and housing affordability also reflect these disparities, with a stark contrast in ownership rates and housing burden between racial groups. These inequities stem from historical policies that denied equal access to housing, education, and credit for non-white groups.

Program Response

In 2024, our Extension education programs focused on addressing these economic inequities through several key initiatives:

Rent Smart: A six-session program designed to help new renters or those with negative rental histories secure and maintain safe, affordable housing. This program reached 1,672 participants, with a significant portion from racial and ethnic minority groups.

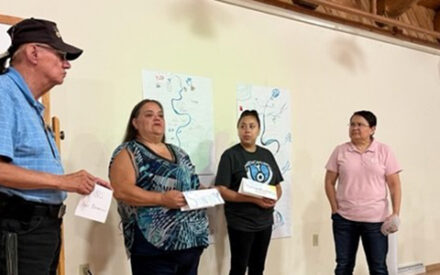

Encouraging Financial Conversations (EFC): A six-session course for frontline workers, equipping them with tools

to help their clients achieve financial goals. In 2024, EFC reached 83 participants, including booster sessions on trauma-informed strategies.

Reentry Ready: Focus on Finances (RRFF): An

eight-module course for incarcerated individuals, preparing them for financial success upon reentry into society. In its first full year, RRFF served 136 participants.

One-on-One Financial Coaching: Personalized support to help residents manage expenses, pay off debts, and save for emergencies. In 2024, 449 participants and their families benefited from these services.

Impact and Outcomes

Our programs have shown significant positive outcomes:

• Rent Smart: 78% of participants reported that the program would help them obtain appropriate housing, and 99% believed it would help them maintain housing. Follow-up surveys indicated that 84% of those who moved found safer, more affordable, or better-quality housing.

• EFC: 92% of frontline workers felt more prepared to discuss financial topics with clients. Participants highlighted the importance of focusing on clients’ financial goals to gain their buy-in.

• RRFF: 87% of participants learned to track their income and expenses, 93% understood how to obtain and read their credit reports, and 91.5% learned initial steps for managing debt.

• Financial Coaching: Among 125 clients, 117 identified family financial goals, and 101 felt more empowered to tackle financial challenges independently. Clients collectively saved $35,850 and paid off $43,560 in debt. Additionally, 80% reported increased hope, confidence, or motivation.