What is Credit? Why is it Important?

Credit can give you the ability to buy an item or service with money that you borrow from a creditor such as a bank or credit union. You would then pay back the money you borrowed (usually with interest–the cost for the ability to borrow money) by a deadline date or over a period. Credit is important because it can help you buy items you need or want, such as homes and cars, without having all the money up front.

A creditor is a person or businesses you owe money to. Creditors decide whether to loan money to a person based on the creditor’s belief the person will pay back the money. In the United States, creditors use a person’s credit report and score to decide if they will offer them credit. This module provides information on credit, so you understand how to use credit to support your financial wellness.

This module takes about 30 minutes to complete. By the end of this module, you will…

…understand what impacts your credit report and determines your credit score.

…know how to check your credit report.

…have learned ways to build and improve your credit.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

The balances on your credit cards determine your credit score.

False, the most important factor of your credit score is your payment history, so making your payments on time and paying at least the minimum payment every time is important. Other things that affect your credit score are your credit card balances (the amounts you owe on your credit card bills), length of your credit history, recent credit inquiries, and your credit mix.

You cannot get a credit card if you don't have a credit score yet or your credit score is low.

False, even if you don’t qualify for a traditional credit card, you can apply for a secured credit card. You need to pay a deposit to get a secured credit card, but you can get a secured credit card even if your credit score is low or if you don’t have a credit score yet. Using a secured credit card will help you build up your credit score.

Checking your own credit report or credit score does not have an effect on your credit score.

True, checking your own credit report or credit score does not have an effect on your credit score. Only “hard inquiries” have an effect on your credit score. Lenders perform hard inquiries when you apply for a new loan or credit card with them. So, it is best not to apply for new loans or credit cards more often than once every six months to minimize the impact on your credit score.

What is a Credit Report & Score?

Your credit history is listed on your credit report. In the United States, three credit bureaus (Experian, TransUnion, and Equifax) keep a credit report for you. Creditors, such as credit card companies, report your borrowing and repayment information to these credit bureaus. This information is then included on your credit report. Examples of information on your credit report include:

- The number of loans you have taken and their amounts

- Your repayment history including on time, missed, and late payments

- Financial events such as repossessions, foreclosures, and bankruptcies

Your credit report’s information is used to calculate your credit score, a 3-digit number, which ranges from 300 to 850. Creditors use your credit score to decide if they should offer you credit. This is known as your credit worthiness.

You will get a credit score, often called a FICO score (the most common type of credit score), when you have had a credit account open at least six months from a creditor that reports activity to credit bureaus. Banks and credit unions almost always report all activity to credit bureaus. Payday lenders and other alternative providers usually do not.

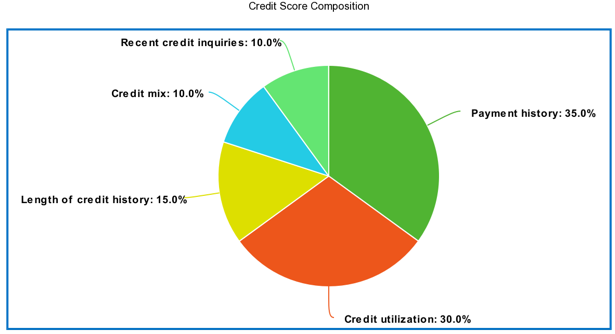

How is Your Credit Score Calculated?

Factors that influence your credit score are:

- Payment history

- Always do your best to make your payments on time and pay at least the minimum payment every time.

- Credit usage–the amount you owe

- Keep your credit card balances low. You should aim to keep your balances at lower than 30 percent of the credit limit on each of your credit cards. For example, if your credit limit is $1,000, keep your balance below $300 to maintain an optimal credit score. You will also be charged interest whenever you leave a balance on your credit card for over a month, so it is best to always pay all credit card balances off in full so you will not be charged extra for your purchases.

- Length of credit history

- Keep old credit accounts open. Keep your old credit accounts, if possible, even if you are no longer using them, especially if keeping them open will not incur an inactivity fee. The old credit histories boost your credit score. Also, the higher your total credit limit is, the lower your credit utilization rate is, so your credit score will improve due to that as well

- New Credit

- Do not apply for many credit accounts during a short period of time. Whenever you apply for credit, the creditors perform a hard pull, also called an inquiry, on your credit history. These hard pulls have a negative effect on your credit score. So, it is best to not apply for new credit any more often than once every six months if possible. The exception to this is if you are applying for mortgages or car loans. It is assumed that you will want to apply to several financial institutions to see who has the best terms. If all your applications for the same purpose (e.g., a mortgage loan) are in a 30-day period, they will count as one inquiry.

- Credit Mix

- This factor focuses on the different types of credit on your credit report. Examples of types of credit include installment credit (ex: car loan that your pay each month until loan is paid off) and revolving credit (ex: credit that does not have a predetermined end date like credit cards). It is not necessary to have all different types of credit. However, a mix of these types may benefit your credit score.

How Can I Check my Credit Report & Score?

Check and correct your credit reports at least once/year from each of the three credit bureaus. Order your free credit reports through this government website: AnnualCreditReport.com. This Money Matters module instructs you on how to request, read, and correct your credit reports: Explore Credit Scores and Credit Reports. You can contact the credit reporting agencies if you believe there are errors in your report, and you can make plans for paying off any legitimate debts you find.

Here are more tips on how to get and keep a good credit score.

You can check your credit score for free in one of these ways:

- Check with your bank or credit union. Many financial institutions offer free credit scores to their customers.

- Use a credit score service. There are many websites and services that offer free credit score checks. Make sure to search information about the website or company to make sure they are legitimate before you give them any of your information. Note that the score you get from these sites may not be the same as the one you get from a lender.

What if I do not have any credit or want to improve my credit score?

Achieving a higher credit score takes time, but it is possible to get started quickly with simple steps. You can improve your credit score in just a few months by following the tips in this module. Maintaining a good credit history is important so you can have higher credit limits, lower interest rates, and be more likely to get a mortgage or a new car loan without added fees or higher rates. Lower interest rates can save you thousands of dollars over time.

Specific strategies to build your credit include:

Secured Credit Cards

If you start building your credit score from scratch, you may need to start with a secured credit card. A secured credit card is exactly like a traditional credit card, except you need to make a cash deposit that the credit card company can draw from if you do not make your payments. The deposit amount varies but is typically between $200 and $500. You will get the deposit back when you close the account.

Otherwise, secured credit cards work like normal credit cards. You use it to buy things, you make payments on it, and you pay additional interest if you do not pay your balance in full every month. So, make sure to pay off your entire balance every month to avoid extra interest payments. Using a credit card helps build up your credit history and credit score. When your credit score goes up enough, you can switch from a secured credit card to a regular one, which may come with extra benefits like a cash back bonus.

Have a Co-Signer or Become an Authorized User

You can get a loan or an unsecured credit card easier if you have a co-signer, such as a family member or a spouse, with a good credit history. However, you and the co-signer should keep in mind that the co-signer is fully responsible for the full amount owed if you fail to pay back your loan.

Another way to build credit with a close family member or a spouse with a good credit history is by becoming an authorized user on one of their credit cards. As an authorized user, that credit card’s activity is reported to credit bureaus and will affect your credit score positively, if payments are made on time and the balance is kept low. You do not even need to use the credit card for it to have an impact on your credit score. Keep in mind that there may be a negative impact on your credit history if the main user fails to make payments or keeps a high balance.

Here are more tips on how to get and keep a good credit score.

Additional Resources

This Money Matters module has more information about this: Explore Credit Scores and Credit Reports

[/collapsible]

Test your knowledge

How to Build Credit Quiz. Take this 10-question quiz to review the basics and test your knowledge. You can take it as many times as you want.

Certificate of Completion

Wisconsin residents: If you’d like a certificate of completion for this module, be sure to contact a UW-Madison Extension Financial Educator to find out about program requirements.