The Division of Extension Natural Resources Institute works at the crossroads of communities, natural resources and agriculture.

Programs, Centers and Current Initiatives

Affiliated Programs and Centers

Programs with impact.

Our educators, researchers and specialists are leading and supporting water, forestry, geology, conservation, environmental education and wildlife projects across the state and region.

Did you know:

- we have a network of WAV volunteers that monitors 600+ stream locations throughout the state?

- our trained Master Naturalists have contributed over 146,000 volunteer hours to local community projects since 2013?

- the Lake Superior Reserve is one of only two estuarine research reserves on the Great Lakes?

- the North Central Region Water Network is funding and leading critical water quality projects across a 12-state region?

- the Wisconsin Geological and Natural History Survey has been conducting research on the state’s rich geologic history since 1897?

- Upham Woods Outdoor Learning Center facilitates thousands of environmental learning opportunities each year through in-person and virtual camps, workshops, data collections and storytelling projects?

News Updates

Blog

Upcoming Events

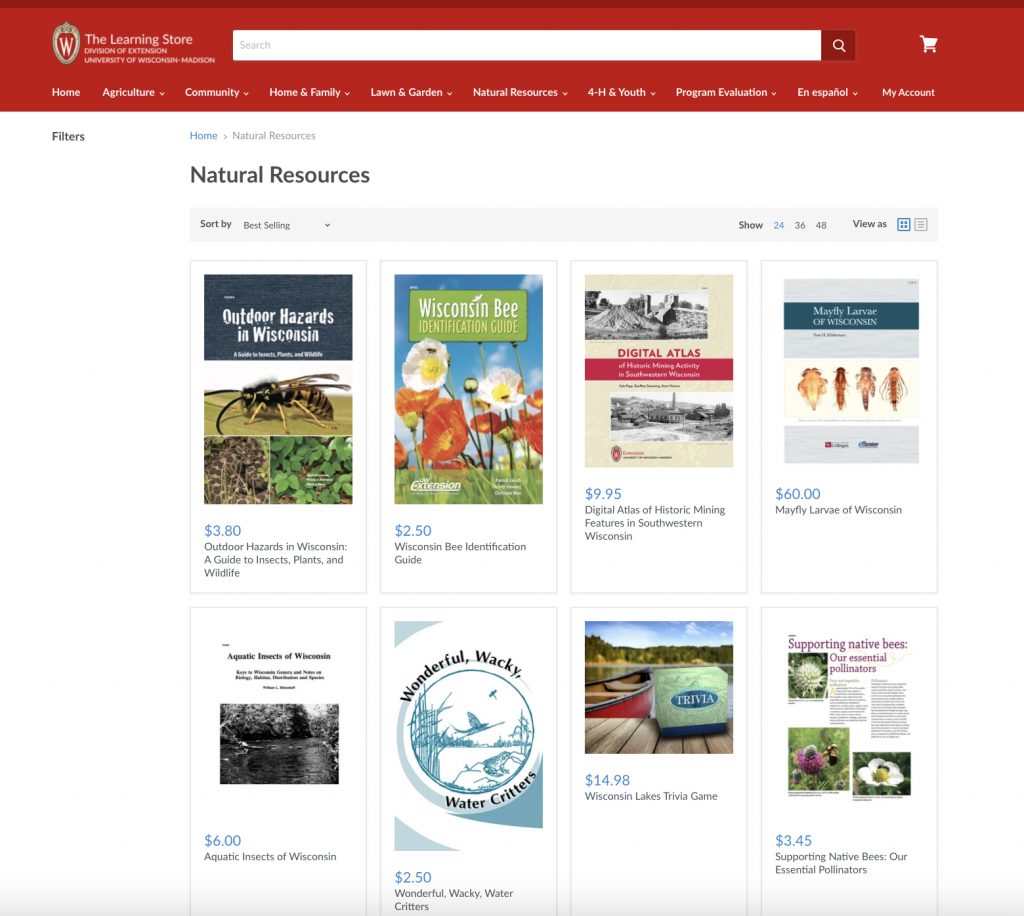

Natural Resources Publications

The Learning Store is your source for Extension natural resources publications, guides, summaries and more!

View related topics on the Learning Store:

Find Your Local Office

Extension experts live and work in the communities they serve. Our team offers insight and solutions based on a deep understanding of local needs and priorities.

Part of the Agriculture, Natural Resources & Community Development Program Area

Our institute is part of Extension’s Department of Agriculture, Natural Resources & Community Development. The department helps producers, farmers and businesses build stronger and more diverse farm and food systems and works with communities and regions to support land and water resource needs.

Director

Tricia Gorby is the director for the Natural Resources Institute. Tricia also worked as the implementation manager for the nEXT Generation project with Extension. Prior to joining Extension, Tricia served in several roles at the Wisconsin Department of Natural Resources.