Wisconsin ranks at the bottom of most metrics related to economic racial inequities. In an annual survey using data from multiple federal agencies, Wisconsin ranks 50th in racial equality among the 50 states (as measured across 21 metrics; only the District of Columbia ranks lower). Wisconsin data also show that between 2000 and 2019, the wage gap has increased between both Black and white men, and Black and white women.

According to 2022 American Community Survey data, 9% of white Wisconsin residents live in poverty compared to 27% of Black residents, 23% Native American, 19% Latinx and 12% Asian. As of 2023 73% of white Wisconsin residents own homes compared to 25% of Black residents. According to 2022 data, 65% of Wisconsin renters are housing-burdened, meaning they spend over 30% of their income on housing.

These disparities are in large part due to the lingering effects of historical policies that denied many non-white groups equal access to things such as housing, post-secondary education, and credit. Due to the sharp economic racial inequities in Wisconsin, we chose in 2023 to focus on work toward achieving this outcome: Addressing economic inequities and systemic racism: Increased access and ability to navigate systems such as opening accounts at financial institutions, checking credit reports, securing housing, and creating estate planning documents.

Extension education plays a critical role in linking low-income residents with local programs that support their access to financial services such as low-interest auto loans through education and one-on-one coaching that qualifies them for those programs.

Building Economic Mobility

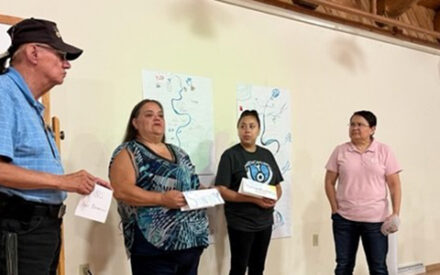

Addressing a problem as entrenched as economic inequity requires multiple approaches. In 2023 efforts focused on these programs: Rent Smart, Encouraging Financial Conversations (EFC) for frontline workers, Reentry Ready: Focus on Finances (RRFF) for incarcerated residents, and one-on-one financial coaching and education. Rent Smart is a six-session program that helps those new to renting or with negative rental records gain the knowledge and skills to help them attain and keep safe and affordable housing. Encouraging Financial Conversations is a six-session course for helping professionals to train them in how to help their clients reach their financial goals. Reentry Ready: Focus on Finances is an eight-module course that helps those impacted by the legal system to prepare for financial success when they reenter society.

In 2023, our Rent Smart program served many racial and ethnic minority groups at higher percentages than their proportion of the state population. The program reached 1,648 participant contacts; 12% were Latinx compared to 8% of Wisconsin’s population, 22% were Black/African American (Wisconsin: 6%), 5% were Native American (Wisconsin: 1%), 7% were two or more races (Wisconsin: 6%), and 1% were Asian (Wisconsin: 3%).

EFC provides social workers and other frontline case managers with tools that enable them to help their low-income clients take charge of their finances and reach their goals. Our EFC program for frontline workers reached 81 contacts in 2023. EFC creators added content to the curriculum about trauma-informed approaches that professionals can use to recognize the impact that clients’ pasts and the systems in which they live can have on the decisions they make.

Reentry Ready: Focus on Finances helps people impacted by the legal system learn how to set financial goals, create a budget, track spending, build credit, get out of debt, and more to help prevent recidivism upon their release from incarceration. 2023 was the first full year of providing this program and 88 individuals participated.

The financial coaching program provides one-on-one support that helps residents create their own plans to manage expenses, pay off debts, and save money for emergencies and to reach their goals. In 2023 approximately 482 participants and family members benefited from these services across Wisconsin.

Through Rent Smart, Encouraging Financial Conversations, Reentry Ready: Focus on Finances and one-on-one financial education, in 2023 Extension served 2,299 contacts who are often left out of efforts to build economic mobility.

Setting & Achieving Financial Goals

Among Rent Smart survey respondents in 2023, 86% said the class helped them obtain appropriate housing in the future; 100% of respondents said the class did or may help them keep housing in the future. We know from follow-up surveys that nine out of 10 respondents who moved since completing the course report that the new housing is safer, more affordable, and/or better quality. In 2023 Rent Smart train-the-trainer survey results, 95% of community service provider participants feel moderately or definitely able to help clientele sustain housing once it’s acquired (compared to 59% before).

In our EFC course that teaches frontline workers how to talk about finances with their clients, 92% of workers who took our survey in 2023 “feel more prepared to bring up a financial topic with clients.” One example of something meaningful they learned that they will apply from the course is that trauma-informed care strategies and approaches offered in the class can be a guide use as coaches/counselors.

Of the 88 participants who completed evaluations during the first year of the Reentry Ready: Focus on Finances program, 92% said the course helped them learn a lot about how to track the money they have coming in and going out, and 87.5% said they learned a lot about the first steps to take when dealing with debt (the other 12.5% said they learned a little). One example of something from the course that they will use is that they plan to use the tracking and building and earning credit history lessons to create better opportunities.

Across the state, residents who received our financial coaching reported many positive changes. Out of 199 clients, 190 identified family financial goals and 166 felt empowered to tackle financial challenges independently, suggesting that these residents can now more successfully navigate banking and other financial services. Two thirds checked their credit report, which prepared them for applying for loans or credit cards. Among financial coaching clients, 32 reported paying off specific amounts of debt for a combined total of $142,393. Also, 85% said that they have increased hope, confidence, or motivation since participating in financial coaching.

Evaluations of these financial education programs demonstrate they are building participants’ skills to set and achieve financial goals that allow them to build strong futures for themselves and their families.