Record high farm income in 2022 drove Wisconsin farm businesses’ interest in new revenue streams, markets and technology. However, in 2023 producers encountered increased interest expense, increasing debt and reduction in working capital due to lower than expected prices, increase in overall production costs, and a decline in USDA assistance.

As a result, producers must make strategic decisions regarding how well an investment will reduce costs, increase revenue, or both. Additionally, businesses must analyze decisions based on potential volatility in the event of another market shock. Producers need to perform financial analysis, assess feasibility, and employ risk management practices in order to make informed decisions for a profitable business.

In particular, beginning, early career, and specialty crop farms have increased financial and risk management challenges. They typically own fewer assets and experience barriers to accessing financial capital. Research shows a lack of understanding of risk management practices, a need for financial education, and help identifying strengths and weaknesses of their business to assist them in making decisions. They also seek an opportunity to implement newly learned concepts into their decision-making process to assess and improve their farm profitability.

When making business decisions, farmers rely on trusted partners such as consultants, lenders, and other types of service providers as well as agriculture associations and producer peer groups. These partners in turn rely on Extension for objective, research-based farm business management information and resources. They also help improve and increase Extension’s impact by informing program development based on farm business needs and collaborating with Extension specialists to deliver and evaluate programs. These partners are key stakeholders of Extension programs; their relationship is critical to developing and implementing curriculum, tools and resources that result in profitable farm businesses.

Farm Financial Literacy

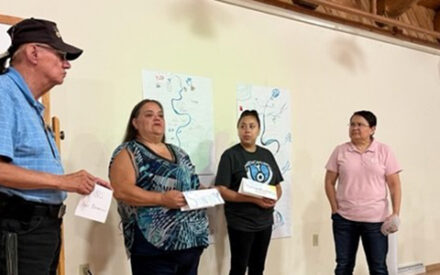

Extension partnered with 12 agricultural associations and community organizations, including Wisconsin Farm Bureau Federation, Wisconsin Farmers Union, Wisconsin State Cranberry Growers Association and Hmong community organizations, to facilitate focus group discussions with over 120 participants. The discussions explored farm management needs of beginning and early career grain and specialty crop farmers and aided them in identifying strengths and weaknesses of their business that would assist them in making decisions to improve their farm profitability. The collaboration leveraged relationships with key stakeholders to improve program development in financial and risk management that would address the most important issues facing beginning and early career grain and specialty crop producers, including Hmong farmers.

The Extension Farm Pulse: Financial Management and Analysis course is self-paced, online and available year-round to farmers interested in learning how to use their financial data to explore their farm business decisions. Participants follow a case farm of choice throughout the series of eight modules, completing hands-on, interactive financial activities. Participants then transfer these skills to their own farm businesses by identifying and collecting records, developing financial statements, and interpreting financial statements for the analysis of a farm’s financial position and financial performance. Extension collaborated with the USDA Farm Service Agency to offer accreditation upon course completion, helping farmers meet requirements of the USDA Beginning Farmer Program, which provides low-interest farm loans to beginning and early career farmers.

In collaboration with the Professional Dairy Producers of Wisconsin (PDPW), Extension provided expertise and instruction for an in-person Financial Literacy for Dairy® program for Wisconsin farmers. Participants choose between three levels of training, each offering between 4 and 6 days of in-person meetings in a peer group setting. This program meets the demands of farmers who are motivated to apply financial concepts for a deeper analysis of their dairy business to inform decision-making and improve profitability. Participants improve profitability of their businesses by increasing their understanding of farm financial data and implementing analysis of their farm financials to determine potential management actions.

Analyzing Farm Finances

As a result of Extension’s work facilitating farmer focus groups in 2023, Extension and partners increased shared knowledge of organizational priorities, roles, and capacity to address needs of beginning and early career grain and specialty crop farmers and Hmong farmers. Challenges identified by participants include overall risk management, labor, financial management, automation and technology, access to capital and working with lenders, and business transition. Land access was also identified and is a particular challenge for Hmong farmers, including low supply of available land and barriers to leasing or purchasing land, including finance and negotiating rental contracts. Participants indicated preferred ways to receive educational information including in-time learning via podcasts, short video, and facilitated peer learning.

Feedback provided by farmers participating in Extension financial management programs in 2023, indicated they (90%) learned the purpose and value of financial management practices. They increased knowledge of how to prepare their farm business financial statements and will now be able to conduct a financial analysis of the financial statements to review their farm’s financial position and financial performance (100%). As a result, they will be able to make a decision about a business opportunity or new enterprise and learn how to determine whether a business opportunity is likely to succeed (100%).

One participant stated: “I plan on using the model to determine when and how best to expand the operations into either increased production or expanding into something new based on projected profitability of different enterprises.” Another said: “I learned to prepare the balance sheet, income statement and cash flows each month and year.” And another stated: “I liked that I could pick up and start the program when it fit my schedule versus having a designated time to login and meet. The flexibility helped greatly!”

Farmers who participated in Extension financial management programs go on to employ farm financial and risk management concepts, tools, methods, and practices to make an informed decision about a business change, opportunity, or new enterprise. Participants of the PDPW financial literacy course and the Farm Pulse course were evaluated in 2023, five months after participating in the programs. Feedback was provided by respondents who completed either course ranging from 14 different Wisconsin counties. 95% of participants who completed either course agreed that not only had their ability to analyze farm finances had improved due to their participation, but they were making direct management decisions based on those analyses. Demonstrating that participants were taking the strategies from the course and implementing them into their business activities. Additionally, more than 75% of the respondents believe their overall financial situation had improved due to participating in Farm Management’s financial courses.

Download Article

Depth-to-Bedrock: Updated Mapping & Decision-Making

Depth-to-Bedrock: Updated Mapping & Decision-Making Building High-Quality Programs to Help Youth Thrive

Building High-Quality Programs to Help Youth Thrive Nature’s Navigators: Supporting Neurodiverse Learners

Nature’s Navigators: Supporting Neurodiverse Learners Centering Culture & Language in Leadership Programs

Centering Culture & Language in Leadership Programs