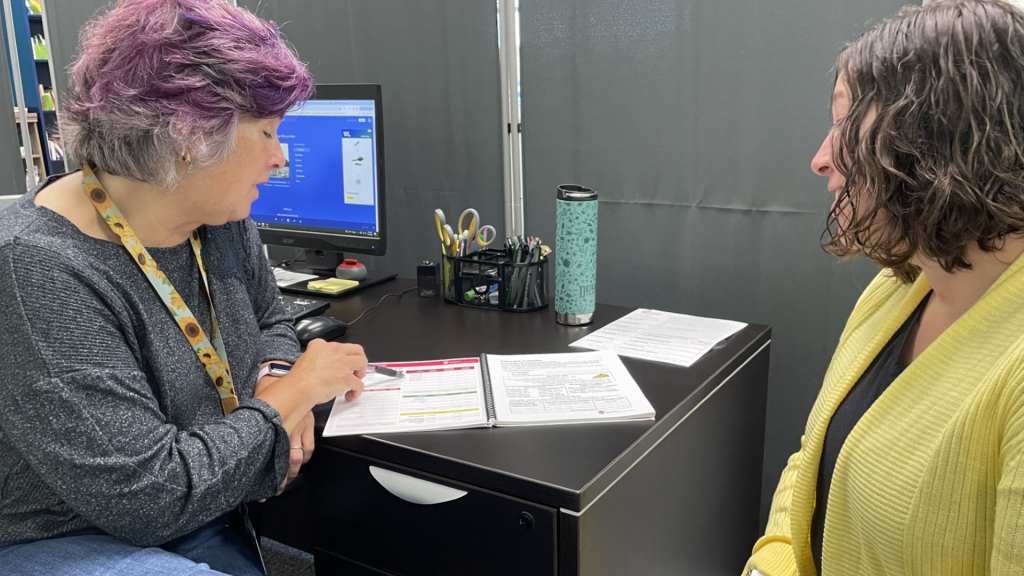

In her role with Early Head Start, Keri Kraus works with families from pregnancy until children turn 3, visiting them in their homes for 90 minutes each week. Kraus brings activities for the children, encouraging the parents to join in. Part of that time is spent supporting the entire family and helping them set and work toward goals. “We get to know the entire family, as you can imagine,” said Kraus, “So we kind of help navigate the resources within the county they need help with.”

While Kraus understands financial management personally, she was hesitant to work with families on financial issues. “This conversation about finances has come up all the time, and I personally know how to finance and how to budget for myself,” said Kraus, a Child & Family Specialist with the National Centers for Learning Excellence who works with the Early Head Start program in Washington County. “Just because you know, it doesn’t mean you know how to teach it. You don’t know all the pieces that you should talk through with someone who doesn’t know anything.” When Kraus heard about Extension’s Encouraging Financial Conversations class, she registered. “The financial training gave me tools that I could share with people and new ideas that I had never even heard of.”

Providing tools and resources for teaching

Encouraging Financial Conversations (EFC) is a six-session course providing those, like Kraus, who are in the helping professions with tools and resources to coach their clients. Through the sessions, professionals learn about financial problem-solving, goal setting, spending plans, saving, building credit and managing debt, maximizing income, and protecting themselves from scams, fraud, and identity theft.

In addition, they receive online resources full of tools they can use with their clients to guide conversations and build skills. Kraus found the tools in her resource binder to be a game changer. “I can pick and choose and decide what’s going to work best for the family. Is this one gonna have too much information? Should I find one that’s a little bit more basic?” said Kraus. Having a variety of tools allows her to adjust to the client’s specific goals while honoring where they are starting from as they learn.

Beyond financial concepts

Carol Bralich, Associate Professor and Human Development & Relationships Educator in Fond du Lac County, helped design the curriculum. “Encouraging Financial Conversations is a training or professional development for helping professionals. So that could mean a social worker, a home visitor, like with Head Start or Early Head Start, maybe even someone more specific that has a role with a community action agency or that does some of the financial pieces that they need to be aware of so they can then determine if the client can access other resources,” said Bralich.

The curriculum is centered around economically vulnerable clients impacted by homelessness, food insecurity, joblessness, lack of transportation, challenges due to a disability, and other factors that impede their ability to effectively manage their finances. “It’s not all about knowledge, like knowing what to do, because a lot of us know what to do,” said Bralich. “It’s also about that motivation that might go with following through with actions, whether they know how to do something, but maybe there’s something holding them back or some barriers.”

That’s why the sessions teach both financial concepts, such as how to create a spending plan, and a coaching approach, using open-ended questions to explore the client’s values and what is most important to them. “You really want to think about where each of your clients are at individually, without making assumptions,” said Bralich, “Asking them questions to help them discover what might work best for them allows for growth on their end. Another important piece is finding out if clients have access to resources and what options are available in their area.”

Building confidence

Having conversations about money or finances is not easy for a lot of people; that includes helping professionals. “Because, personally, they may not have a lot of confidence in the area of finances, but they might find themselves in situations with their clients that bring up financial concerns,” said Bralich.

That was the situation that Kari Ives found herself in as a social worker and clinical substance abuse counselor at the Chippewa County Correctional Treatment Facility for adult men. Ives provides counseling to help her clients reintegrate back into society. Often, they find themselves in complicated financial situations, which makes successful re-entry more difficult. Ives has had clients ask for help with things like rebuilding credit, budgeting, and finding housing.

Before taking the EFC course, Ives was reluctant to discuss finances with clients. “I’m one of those people that really don’t like finances. Just let me pay my bill and not worry about anything else” said Ives. Now, she feels much more prepared and comfortable talking with clients. In fact, she credits the class with pushing her to think about finances personally, as well. “Going through the class, I learned a lot. And I’m like, ‘I should start doing this,’” said Ives. “It really opened my eyes to some things, and I started thinking about what I should do, preparing for a rainy day, and just other things to think about in the future. The handouts are so great and make you really be more independent or not scared of finances.”

The need for training

Across Wisconsin, close to 600,000 people live below the federal poverty level, and an additional 1.3 million Wisconsinites live in a household that struggles to cover basic household expenses. Many individuals and families turn to social service agencies for public assistance and other forms of support. This puts social workers, case managers, and other helping professionals on the front lines of supporting Wisconsin’s most vulnerable populations. When they meet with clients, they often have teachable moments during which they can add discussions on critical financial topics.

Dr. J. Michael Collins, a family economics specialist for Extension, the Fetzer Family Chair in Consumer & Personal Finance in the School of Human Ecology, and professor at the La Follette School of Public Affairs, explained that financial education outreach to helping professionals began around 2009, during the Great Recession. “A lot of people had trouble with their housing payments, and they were trying to navigate all kinds of systems like foreclosure prevention they were trying to get. Sometimes they were out of work, and they were trying to navigate unemployment. They were trying to navigate food assistance–all kinds of stuff,” said Collins.

During that time, there was a movement to provide more financial counseling. But it was clear that mortgage servicers, lenders, and traditional financial planners were not in a good spot to do so because they were not trained to work with people outside traditional financial systems. “It turned out, you know, it makes a ton of sense to use the caseworkers and the people who are on the front lines working these programs. And for them, most of them had never been trained,” said Collins.

Collins was part of the first programming that Extension provided to helping professionals. He found that while they were used to talking with their clients about very sensitive topics like drug use, mental health, and physical safety, they found discussing budgeting with clients uncomfortable. “We were training them on talking about finances, and they were like, ‘Oh, no, that’s way too personal. We can’t talk about money,” he said, “That was a light bulb moment for me.” He saw that training could change their perspective on having financial discussions. Just like other topics that helping professionals are trained to handle and discuss on a regular basis, “Once they have that comfort level, this becomes just part of standard operating procedure.”

Making a difference

Ives is thankful that the Human Development & Relationships county educator in her county, Jeanne Walsh, offers the course in Chippewa County. Having a better understanding of finances and easy-to-use resources allows her to help her clients. “You know, there’s so many nerves when they are released. If we can give them some things to think about and resources to reach out to, to help them be a little bit more prepared, I think that’s better for us and them,” said Ives. She sees the value in learning the concepts but also in having resources that can be adapted to each individual. “With the background, I can just look in this great workbook that we got [in the course] and think about what he wants to work on. So what in here is going to be best serving him?” That gives her the confidence to have those conversations because she knows that she has the tools to help explain it.

Extension has a history of delivering a variety of training programs for professionals who address poverty in their work, so focusing on financial management and education was a natural fit. Since EFC’s launch in 2020, workshop participants reported an increased comfort level working with clients on financial matters and felt more prepared to bring up a financial topic with their clients. The course has also helped participants understand the role they can take in working with clients on financial concerns. Within 2 months after participating in the course, the majority of learners used resources to hold financial discussions with clientele, and more than two-thirds of participants applied the course information to their own finances.

Along with overwhelmingly positive feedback for the course, participants have requested ongoing support and training. In addition to Extension’s suite of financial education courses, such as Rent Smart and Money Matters, the EFC team created booster sessions specifically designed for professionals who completed the 6-session EFC course. Booster sessions are focused on specific topics and allow participants the opportunity to practice strategies, ask questions, and learn about additional financial resources. They also provide an opportunity for professionals to network and share challenges with others who are working with vulnerable populations.

Benefiting communities

While her day job is social work, Ives has served as a Chippewa County Supervisor for nine years and currently chairs the Chippewa County Health and Human Services committee. During her time serving in local government, she has been part of a lot of discussions and decisions that affect families. She sees the importance of programs like EFC for both her clients and her community. “There’s so many people that fall through the cracks, that just don’t have the simple basic tools of what you need to find resources or how to hold on to your money,” said Ives. “And I think it strengthens our community and the people that Extension works with to be more self-reliant and make them stronger so maybe they can get a loan on their first house or could buy their first car that they’ve never been able to.”

Collins emphasized the impact of financial capability for communities. “So many aspects of what we do in local government involves the ability to have people budget, manage payments.” Whether that’s food assistance, paying utility bills or court fees on time, or paying property taxes, our communities operate more efficiently and effectively when residents know how to manage basic household finances. “If we can build that capacity into our systems, it’s like a super vitamin. It makes all of our systems work better.”

Find the latest registration information on the Encouraging Financial Conversations website.