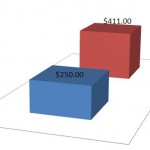

The federal government’s Troubled Asset Relief Program (TARP) was established in 2008 to help stabilize and strengthen the U.S. financial system. Under TARP, the U.S. Treasury was authorized to distribute up to $475 billion to banks and other financial institutions. The US Treasury disbursed a total of $411 billion through TARP.

The federal government’s Troubled Asset Relief Program (TARP) was established in 2008 to help stabilize and strengthen the U.S. financial system. Under TARP, the U.S. Treasury was authorized to distribute up to $475 billion to banks and other financial institutions. The US Treasury disbursed a total of $411 billion through TARP.

The U.S. Treasury reports that, as of March 24th of 2011, those participating in TARP have repaid $250.8 billion of the $411 billion they received through TARP. The Treasury has received another $37 billion in interest, dividends and capital gains on their investments in these companies. In total, $287.8 billion (70%) of the money dispersed through TARP has been recovered.

The banks participating in TARP received$245.5 billion (60 percent) of the total $411 billion disbursed. According to the Treasury, $243.8 billion in cash (99% of the $245.5 billion dispersed) has been repaid by the banks participating in TARP. That includes $211.4 billion in repayments and $32.4 billion in interest, dividends, and capital gains.

Our information for our TARP series comes directly from the U.S. Treasury. Their blog, Treasury Notes, connects citizens with what’s going on at one of the oldest departments in the U.S. federal government. To find similar data, start here at the U.S. Department of the Treasury: http://www.treasury.gov/connect/blog/Pages/TARP-by-the-numbers.aspx. The information is stored a little more professionally on the Daily TARP Update, which can be found here: http://www.treasury.gov/initiatives/financial-stability/briefing-room/reports/tarp-daily-summary-report/Pages/default.aspx. This report, from 3/24/2011, states at the end of the report that $250.8 billion of the $410.7 dispersed has been repaid.