Simon Jette-Nantel. Extension Farm Management specialist simon.jettenantel@uwrf.edu

Arlin Brannstrom, UW Center for Dairy Profitability ajbranns@wisc.edu

Over the last 5 years, Wisconsin land values remained strong despite difficult economic conditions and substantial losses in the number of dairy farms. The Wisconsin Agricultural Land Prices Report, by the University of Wisconsin-Madison Division of Extension provides a statewide overview of agricultural land values/prices across Wisconsin based on a statistical analysis of more than 8,000 actual sales from 2009-2019, including township level data, land values versus rental rates, influencing factors, and implications for agriculture.

Over the last 5 years, Wisconsin land values remained strong despite difficult economic conditions and substantial losses in the number of dairy farms. The Wisconsin Agricultural Land Prices Report, by the University of Wisconsin-Madison Division of Extension provides a statewide overview of agricultural land values/prices across Wisconsin based on a statistical analysis of more than 8,000 actual sales from 2009-2019, including township level data, land values versus rental rates, influencing factors, and implications for agriculture.

Farmland is the most valuable asset on most farmer’s balance sheet. However, estimating land values is always difficult. Each individual parcel of land is unique. Besides location and land productivity/fertility, a number of other factors influence land values. Farmers represent the majority of farmland owners and buyers, therefore farm income and farmers’ access to capital has a large influence on land values.

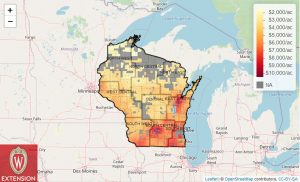

Land Values across Wisconsin

Between 2014 and 2019, the average annual growth in Wisconsin agricultural land value was 1.8%. Adding those capital gains to a rental income of about 3.25% would give landowners an average annual return on investment of 5.05%. Given that farmland is a low-risk investment, this return compares advantageously to other investments such as low-risk corporate bonds which averaged 3.75% over that period. During the time period of this study, the vast majority of landowners, even those forced to exit dairy, were not necessarily forced to sell their land. Most could continue cropping or rent the land, thus limiting the supply of land on the market and help supporting market values.

Signs of a weakening demand have appeared in 2019, and things may not improve in 2020 given the high level of uncertainty surrounding commodity price projections. The lower interest rates and various financial help packages offered by the government provide hope for land values to remain steady in 2020. As of June 1, 2020, the data for the first quarter of 2020 indicated stable land prices and did not show any negative impact from the COVID-19 crisis.

The Wisconsin Land Values report offers an interactive map that shows estimated 2019 agricultural land values at the township level based on the analysis of almost 9,000 real estate transactions between 2009 and 2019. The model used to generate those estimates for cropland values takes into account the location, year, and the mixture of land uses of each transaction.

Influence of Rental Rate and other factors on land values

In recent years rent has been relatively high compared to value, leading to a higher return to land ownership relative to land rental. The 2019 NASS Wisconsin average rental rate for non-irrigated cropland was $137/acre which is about 3.2% of the state-wide average sale price. Ten years ago, land rents were low relative to land prices, leading to intense competition for land rental and ultimately to a rapid increase in rental rates (8.4% increase per year between 2010 and 2014). Given the strategic importance of land control in farming, current high rental rates are unlikely to go down significantly despite the economic hardship of the agricultural sector.

The pressure created by growing environmental concerns and the concentration of livestock in some areas has heightened the value of land for nutrient management purposes. In those areas, that use may be a dominant factor in driving demand, even more so than crop and feed productivity. Hence, livestock concentration has also become a key factor affecting local land values in Wisconsin.

Another factor that can help stave off a downturn in land values is the ability of landowners to hold on to their property. The secret to successful real estate investment is the ability to hold on to the asset for long periods. As long as most landowners in a given area will be able to hold onto their parcels until the markets bounce back, the supply of land on the market will remain low and that can go a long way in supporting land prices.

The full Wisconsin Agricultural Land Prices report is available online at https://farms.extension.wisc.edu/articles/wisconsin-agricultural-land-prices/