Vea esta pagina en español aquí: Cooperativas de crédito, bancos y otras instituciones financieras

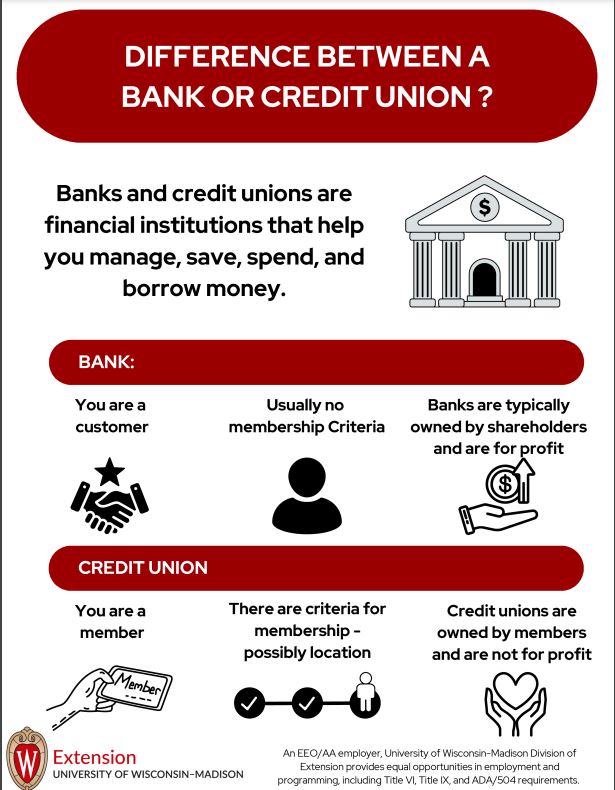

Financial products and services help you manage, save, spend, and borrow money. Financial institutions like banks and credit unions accept deposits of money, lend money, and offer other financial services that can help you.

This module takes about 30-45 minutes to complete. By the end of this module, you will be able to…

- …recognize differences between credit unions, banks, and other financial institutions.

- …identify various financial services offered by financial institutions and how to use them.

- …open and manage a bank or a credit union account.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

You can save money by shopping around for financial products, services, or providers.

True, some financial institutions are a better fit for your situation than others. You can save lots of money in fees and interest by switching from payday lenders and check cashers to institutional banks or credit unions.

You can open a checking account for free with many financial institutions like banks and credit unions.

True, some institutions require a small deposit to open the account, but some may not even require that.

The only benefit to depositing money to a financial institution is keeping it safe.

False, using a bank or credit union can provide you with many benefits, such as interest on your savings and other services like lines of credit.

Financial services are provided by institutions such as banks and credit unions. In addition, financial services are provided by mobile applications, stores, check-cashing stores, payday lenders, pawn shops, and vehicle title lenders, among others.

Commonly used financial products are:

- Checking and savings accounts

- Credit and debit cards

- Mortgages

- Auto-loans

Financial institutions offer other financial products as well such as check cashing, money market accounts, personal loans, Certificates of Deposits (CDs), prepaid cards, cashier’s checks, online banking, and Automated Teller Machines (ATMs).

Let’s learn more…

What's the difference Between Banks and Credit Unions?

The United States government insures most banks and credit unions for at least $250,000 per depositor. So, your deposits at each institution are guaranteed to be protected for at least $250,000, regardless of whether the bank or credit union stays in business or not. Banks display signs that they are FDIC-insured (Federal Deposit Insurance Corporation) and credit unions display signs that they are NCUA-insured (National Credit Union Administration). Make sure your financial institution is insured, both signs mean that they are insured by the United States government and the signs are placed in visible locations in the institution.

Places like pawn shops and mobile applications (Venmo, Chime, Cash App etc.) are not insured by the government because they are not banks. While these companies offer financial services, they do not have FDIC insurance or NCUA insurance. This means that if the company goes out of business, the money you hold in the company’s app or other products could be lost.

You may have the option to open accounts with a local, regional, or national bank. There are benefits to each of these types of banks. Each type of bank may offer personal services such as insurance products, investment advice, and other services.

Local banks, also known as community banks, are the smallest banks. They are often owned by individuals or groups that live in the area and may have just a few branches. Because of their local focus, they strive to provide personalized service to customers and may focus on serving local small businesses.

Regional banks often serve customers in no more than a few states. Because of their regional focus, they may offer a more personalized banking experience than a national bank. Their quality of banking technology may vary but they usually provide access to many ATMs and branches in the areas they serve. ATMs offered by your bank or credit should not have transaction fees. If you use ATMs of other banks or credit unions then you may have to pay fees to use their ATMs.

National banks have branches across the country and usually provide a full list of services and products like bank accounts, credit cards, loans, and investment services. They often use cutting edge technology (ex: online and mobile banking) and provide convenience to customers when traveling because of their many branch locations.

Consumer Financial Protection Bureau has tips on selecting financial products and services.

Opening an account

Why should you open an account at a financial institution?

- It provides safety and security for your money from disasters or theft, insured by the government.

- Many institutions offer free or low-cost services.

- You can earn interest on your savings. Interest on your account is money paid to you by the bank or credit union for holding your money at their bank or credit union.

- Financial services make bill-paying and shopping convenient.

- You build a relationship with your bank or credit union.

How to open an account

Usually, you can fill out an application at one of the institution’s locations by making an appointment or walking in. Some institutions allow you to open an account online or on their mobile application.

You will need to verify your identity by using a driver’s license or passport or other ID card. You may also need to provide them with your Social Security Number (or Individual Taxpayer Identification Number (ITIN)), Date of birth, address, and other personal information.

Once you have set up an account, you will choose the financial services you want. You could be provided with a checking and a savings account, a debit card, online banking, and a line of credit for example. Some banks and credit unions may require a small deposit to open your account. For example, credit unions usually require you to deposit enough money to qualify for a membership. This is usually a small amount, like ten dollars, which you receive back if you close your account.

Your bank or credit union offers different versions of checking accounts, saving accounts, and other products. After explaining your situation, you should ask them to explain which accounts they offer that are low-or-no cost to you. As a customer, you have the right to know which accounts would offer you the most benefits for the least amount of money.

To finish your application, you’ll receive disclosures, sign documents, and can ask any remaining questions you have.

Consumer Financial Protection Bureau has a checklist for opening a bank or credit union account.

What if you are not approved for an account?

You may be unapproved for an account if you have negative banking history such as unpaid balances or suspected fraud.

A common consumer report used by banks & credit unions to review account applications is ChexSystems. You have the right to receive one free banking history report from ChexSystems and other nationwide consumer reporting companies that banks and credit unions use. You can find an up-to-date list of the reporting companies on this List of Consumer Reporting Companies starting on pages 26 – 28. Check the companies’ websites and contact them directly for a report.

If you’re not approved for an account, it is a good idea to request a banking history report, verify that the information they have is correct, and file a dispute if they have incorrect information.

Using financial services

Using a checking account:

- A checking account is for frequent transactions. You can deposit money, make purchases, pay bills, withdraw cash and so on.

- Consumer Financial Protection Bureau has a guide on ways to pay your bills and managing your checking account.

- Most checking accounts have the option to use checks. Checks are small pieces of paper with your account information that you can fill out and give to someone to pay a bill or buy an item.

- Because checking account benefits and costs can change over time, it is important that you check to learn if your account’s benefits or costs each year.

- More checking account tips here: Checking Account Basics.

Debit and credit cards:

- You can use a debit card to pay for things directly from your checking account. A credit card is used to pay for things from your line of credit if you have one. You need to pay back the money borrowed from your line of credit to the institution. If you pay it back before they bill you, you may not need to pay interest on the amount borrowed.

Overdraft fees:

- An overdraft fee (may be $35 for example) is applied by the bank if your checking account balance goes negative (you spend more money than you have available in your account).

- Overdraft fees can be a burden, especially if you live paycheck to paycheck. To avoid overdraft fees, keep careful track of your automatic payments and the checks you write and make sure that you always have enough money in the account.

- Tip: mark your automatic payments in your calendar so you can double-check that you have enough in your account before the money is withdrawn.

- Some institutions may offer overdraft lines of credit. Then, if your account overdrafts, the institution automatically inserts money from the line of credit to your checking account, so you avoid an overdraft fee. Ask your financial institution if you qualify for one.

- Some institutions offer “Bank On” accounts with a small monthly fee of about $5. These safe “Bank On” accounts do not have any overdraft fees. You can find a list of these accounts on the Bank On website.

- This worksheet can be used to determine all possible account fees: Do You Know Your Financial Service Fee Facts.

Using a savings account:

- Usually offers a higher interest rate but is not designed for frequent transactions.

- Use to build savings and earn interest on them.

- For large savings, Certificate of Deposits (CDs) and money market accounts can offer even higher interest rates but may offer even fewer free transactions.

- Additional savings tips here: Savings Account Basics.

Additional tips to manage your account:

- You can use your institution’s services by visiting them in-person or through a drive-through service. Most institutions also have phone service, mobile applications and ATMs.

- Consumer Financial Protection Bureau has tips when using mobile devices for financial services.

- You can set up direct deposit through your employer to receive your paycheck directly in your account. When you set up direct deposit, you can automatically send money to just your checking account or to multiple accounts, which would allow you to send money to your checking account and some money to your savings account. .

- Many bills can be paid automatically but be careful when setting up auto-payments to make sure you always have enough in your account when the payment is due.

- You can cancel automatic payments by contacting the billing company, or your bank. You can also send your bank a letter like this: Sample Revocation Letter To Your Bank Or Credit Union (Downloadable Word document).

- Check your monthly statements from the institution to make sure you’re only getting charged for things you have spent money on.

- If you ever lose a debit-, prepaid- or credit card, report it to the institution immediately. They can close it quickly to stop someone else from using it. You may also have the option to report that your card has been lost or stolen in your bank or credit union’s mobile app.

- Sometimes if you use a card in an unusual way (for example an unusually expensive purchase) or location, the institution may deny its use by “flagging” the card. If this happens, contact your institution to confirm that it is you who is trying to use the card. They do this to prevent someone else from using your cards. You can avoid your card from getting flagged by letting your institutions know before you travel or make a big purchase.

Other financial services:

Prepaid cards:

- Some stores or financial institutions offer prepaid cards where you deposit money into a card and then can use it to pay for things.

- Can be safer than carrying cash.

- May include fees.

- Are an option if you do not qualify for an account at a financial institution. Some prepaid cards are reloadable, and some are not.

Check Cashers:

- Often charge fees.

- Financial institutions such as banks and credit unions often allow check cashing and direct deposits for no fee.

Money Orders:

- You can buy a money order from a bank, credit union, post office, and even some retail stores to pay a person or a company.

- Fees to buy a money orders can be as high as $5 per money order.

Payday and Auto Title Loans:

- High fees, extremely high interest rate, and short re-payment periods.

- Since 2022, Wisconsin payday lenders have charged annual percentage rates (APR)

exceeding 800% for payday loans, well above the national average of 391%. Nearly 1 in 4 payday loans are reborrowed 9 times or more. On average, it takes borrowers 5 months to pay off their loan, which results in over $500 in finance charges (CFPB, Pew Trusts).

- Since 2022, Wisconsin payday lenders have charged annual percentage rates (APR)

- Risk losing vehicle.

- Credit card advances or personal loans from financial institutions offer much better terms, if available.

- Story about what taking a payday loan might look like in the video below:

Pawn Shops:

- You bring an item to a pawn shop, also known as a pawnbroker. The pawnbroker inspects the item, also known as the collateral, to figure out how much they believe it is worth. They then offer you a short-term loan based on the amount they believe the item is worth of the item. If you don’t pay the loan back by the time you agree to pay it back, the pawnbroker can sell your item.

- Risk losing item, also known as the collateral of the loan, which is often more valuable than the amount of the loan.

Credit Counseling, Debt Management Plan, Debt Consolidation, Credit Repair, Debt Settlement and Negotiation:

- There are good agencies and bad ones.

- Locate a credit counseling agency with a good reputation for a credit report review and to learn about options.

- The State of Wisconsin website has information about reputable counseling agencies, a list of licensed operators, and tips on how to find a legitimate agencies here: Credit Counseling

- Some agencies may include high fees, may over-charge, or may have you paying for a service you don’t need or that you can do yourself.

Online-Only Financial Services and Applications

- In general, deposits are not insured by the government.

- May be a convenient way to transfer money to others.

- Complete the Money Matters module on Navigating Non-bank Financial Technology Alternatives

Frequently Asked Questions About Deposit Accounts for Foreign Citizens

- Can I get a checking account without a Social Security number or driver’s license?

- Can a foreigner open a U.S. bank account?

Financial Coaching

- UW-Madison Division of Extension offers financial coaching free of charge. More information here: Contact a UW-Madison Division of Extension Financial Educator.

Test your knowledge

Financial Services Quiz. Take this 10-question quiz to review the basics and test your knowledge. You can take it as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Madison Extension Financial Educator to find out about program requirements.