It is important to have a retirement plan, even if you are a long way away from retiring from work. About one out of every three 65-year-olds today will live until at least age 90. You can enjoy a more financially secure retirement by taking a few steps to manage your spending, reduce your debt, and make sure you have a way to get income as you get older.

This module takes about 30 minutes to complete. By the end of this module, you will be able to…

- …plan how you’re going to pay for living expenses after you retire.

- …summarize how Social Security benefits work, what age you can start receiving them, and for how much.

- …determine how to use wills, estate plans, and power of attorney for healthcare to make informed decisions for your future.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

Social Security is a retirement benefit that is the same for everyone.

False, the average monthly payment for a social security retirement benefit is about $1,794 per month (Sept. 2023), but can vary a lot based on if you are married or not, the age that you start to get your monthly benefits, and how much money you make over your lifetime.

Social Security payments are usually enough to cover most people's living expenses.

False, most people use a mix of savings, Social Security, and continuing to work to fund their retirement. Some homeowners may even plan to sell their house or downsize in their later years. Social Security alone is not enough to cover most people’s living expenses.

Participating in 401(k) and/or 403(b) retirement savings plans offered by some employers is a great way to build retirement savings.

True, both 401(k) and 403(b) plans are ‘employer defined contribution plans’ which means that they might be provided as a benefit by an employer. Some employers might even add extra money to any savings that you put into the plan.

Making a Plan

The first step is to set some goals for your later years. Think about:

- Do you want to work as you get older, even part time?

- How long do you want to work?

- Where do you want to live when you retire?

- What kinds of things do you want to do as you get older?

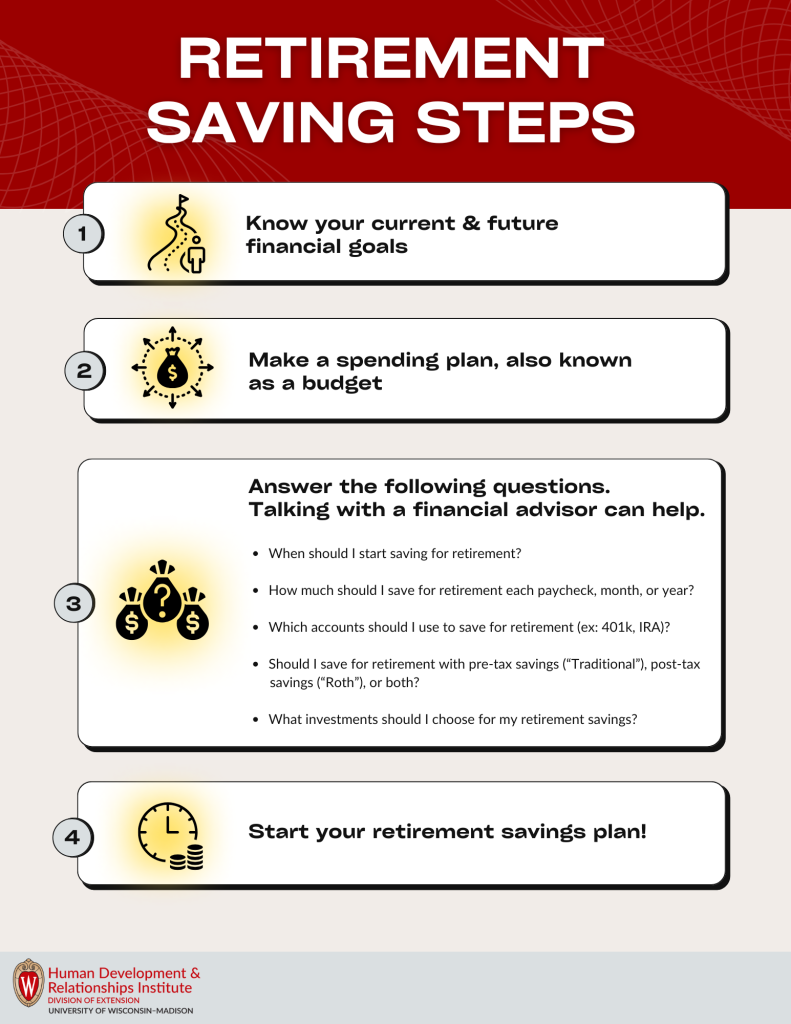

This graphic shows some of the steps included with planning for retirement:

Usually, people have several financial goals and retirement is only one of those goals. Financial goals may include paying down debt too. What do you want to do in the next year that might involve saving or borrowing, like buying a house, going to school, or other life events? How about in 10 years? 20 years? Write down your goals and your timeline someplace you can remember and look at them every few months.

For retirement and other goals, start planning how much you can find in your budget each month. Look into the retirement plan savings you can get at your work. You might want to open up your own private retirement savings account. Financial advisors and planners can help but can be expensive. Before investing your money, ask a lot of questions and never take a step you do not fully understand.

Let’s learn more…

Find out more about how people pay for retirement…

Social Security

Social Security is a retirement benefit paid by taxes taken out of your paycheck. A common myth about Social Security is that the system is ‘going broke.’ Social Security will not go broke—if Congress fails to act, people who file for Social Security could get less than they expected, but they will still get some benefits. People close to retirement age are unlikely to have their benefits reduced at all.

You can claim Social Security as early as age 62, but every month you wait will increase the amount you can get, up until age 70. You have to start getting your benefits at age 70. At age 62, you will receive only 75 cents of every dollar you could get at your “full retirement age” (currently age 66 for people born 1943 to 1954 and 67 for those born afterward). For people with health problems who cannot work, claiming Social Security at age 62 may be the only option. Still, delaying even a few months results in larger monthly payments for the rest of your life.

In 2023, the average monthly payment for a retirement benefit is about $1,794 per month (SSA), but can vary a lot based on if you are married or not, the age that you start to get your monthly benefits, and how much money you make over your lifetime.

- You have to work at least 40 quarters – that’s equal to 10 years — to be able to get Social Security.

- If you have not worked at least 10 years and you are married, you could get Social Security based on your spouse’s work history.

- Divorced spouses and widowers/widows can claim benefits based on a former spouse’s work history if the marriage lasted at least 10 years.

- You can also get a larger payment if you have a minor child at home.

Delaying retirement is one way to improve financial security later in life. You can also collect Social Security benefits while you are still working and getting a paycheck, although your benefits may be reduced if you earn a lot (SSA). This may feel like a ‘tax,’ but these earnings will result in larger benefits later. Social Security will adjust your future monthly benefit amounts and you will get more money in the long run.

It is often helpful to talk to a Social Security counselor about these issues. Excellent resources are available online at the Social Security Administration website, at your local Social Security Administration office, or by calling Social Security at 1-800-772-1213.

Retirement Savings

There are many different types of retirement savings plans. This section will look at 3 different ways people may save money for their retirement:

- Workplace retirement savings

- Individual retirement savings

- Workplace pensions

Most of your retirement savings can be invested in mutual funds or exchange-traded funds (ETFs). These funds often have lower fees that go to the company that’s managing your money. Before investing your money, ask what the fee is. It can be best for the fee to be 1% or less. A special kind of mutual fund, called an indexed fund, tends to have the lowest fees. Learn more about mutual funds & ETFs and investment fees at investor.gov.

Be sure to understand any retirement investments you make, and be careful of the advice of friends, family, and even financial advisors or brokers. Their advice may not be right for you. If you want to get financial advice you can hire a financial advisor. Use this tip sheet to learn more about how to choose a financial advisor.

People can start taking money out of their retirement savings when they reach 59 and ½ years old without paying any penalties for taking the money out early. Most retirement savings plans also allow savers to borrow from the account for special reasons—like paying for a college education or buying a house. There are some “hardship withdrawals” that allow you to take money out of the account and not pay taxes or penalties, but this is rare.

As an added incentive to save for retirement, low to moderate income earners could get a tax credit of up to 50% of the amount they put money into an IRA or an employer-sponsored retirement plan. You can find out more about the Retirement Savings Contributions Credit (also called the Saver’s Credit) on the IRS website.

Workplace Retirement Savings

Many employers offer some types of retirement savings plans, such as a 401(k), 403(b), 457 or other types of plans. These types of plans are also called “defined contribution plans” because the employee is expected to contribute part of their paycheck to the savings account. Some employers will match what you save too. For example, if an employee saves 3% of their income in a 401(k) plan, the employer will also contribute the same dollar amount. A matching retirement account is like getting a bonus!

It is up to you to manage a retirement savings plan by opening an account with your employer and telling the employer how much of your paycheck you’d like to put into it. Some people may have retirement plans from past employers. Often it makes more sense to “rollover” or consolidate these accounts into one account. You own 100% of the money you invest into your retirement plan, but you may not be able to keep your employer’s contribution if you leave unless you work at the company for a certain number of years.

Individual Retirement Savings

Other savings plans are not employer-sponsored, but rather individuals set them up, called Individual Retirement Accounts (IRAs).

- The Traditional IRA gets you a tax deduction this year, but then you pay taxes on your contributions and any interest earned when you use the money in retirement.

- A Roth IRA is different since you pay taxes on the money you invest right away, but then you do not pay taxes on the money you take out when you retire. With a Roth IRA, you can take out the money you put into the account at any time without a penalty. (Note: there’s no penalty for taking out the money you put into a Roth IRA, but there are limits on when you can withdraw the interest your money earned.)

- Generally, if you have a lower income—especially if you are young and have a long time to save— saving in a Roth IRA can be a good choice.

Workplace Pensions

About 1 in 5 workers have a retirement pension today. These types of plans are provided by employers — usually larger private companies and public employers — who pay a monthly benefit when you retire. These pension plans are also called “defined benefit plans” because your employer defines how your retirement benefits will be figured out ahead of time. The employer determines what the retiree’s monthly benefit will be. Some plans also require individuals to contribute a certain amount to their own pension plan.

How much should you save for your retirement?

How much to save completely depends on your financial situation. A general goal for many people is to save 10% of their pay towards retirement. However, the specific amount you save is not as important as building a savings habit.

The sooner you save for retirement, the more time you will have for your money to grow by “compounding.” Compounding happens when interest works in your favor—the money you save earns interest and then you earn more interest on the interest you previously earned. Here is an example:

Let’s say starting on January 1, you save $1 per day for a year. You’d have $365 at the end of the year. If you put $365 into a retirement savings account with 5% compounding interest:

| Information | Explanation | |

| Amount saved in a retirement savings account | $365 | Also called your principal |

| The interest rate you earn on money in your retirement savings account | 5% | Also called your rate of return |

| How often your money “compounds” | Once a year | Also called compounding frequency |

| Amount after 1st year (without you putting more money in the account) | $383.25 | Amount you started with, plus 5% interest. 05 X $365 = $18.25$365 + $18.25 = $383.25 |

| Amount after 2nd year (without you putting more money in the account) | $402.41 | Amount at end of 1st year, plus 5% interest. 05 X $383.25 = $19.16$383.25 + $19.16 = $402.41 |

| Amount after 5th year (without you putting more money in the account) | $465.84 | |

| Amount after 15 years (without you putting more money in the account) | $758.81 |

As this example shows, earning compound interest builds money on top of your money over years. Retirement savings accounts can be great options to use to earn compound interest.

Check out this online retirement calculator on AARP’s website. Available in both English and Spanish.

How to balance retirement savings with other goals and expenses?

Like most people, you will also have other priorities for your money such as paying off debt and saving for an emergency fund. Along with saving for retirement, these goals are important parts of your financial health.

Paying off debt, specifically debt with high interest such as credit cards, is very helpful because credit cards often have interest rates of 20% or higher. Because of their high interest rates, it makes sense for many people to focus on paying down credit card debt while they also save for retirement. Some people may even want to pay down their high interest debt before they begin saving for retirement. The best choice will be specific to your situation.

Having an emergency fund can also make your financial situation more stable. An emergency fund is an amount of money you save and then hold to use when unplanning situations happen like a blown tire on your car or an illness that keeps you away from work. Having this money set aside in a bank account with FDIC insurance to cover emergencies will help you avoid using credit cards or loans to get by. The right amount for your emergency fund is specific to your situation. However, the best thing is to build the habit of saving.

Paying off high interest debt, building an emergency fund, and saving for retirement are all great! One option you can think about is saving a little bit towards each of these great options at the same time.

Let’s return to the example of having $365 saved. You could decide to put $100 towards paying down debt, $100 towards your emergency fund, $100 towards retirement savings, and $65 towards enjoyment. When all your credit card debt, and any other high interest debt, is paid off and you have an emergency fund, then you can put the money you normally use for that into retirement savings. You can also use this approach to decide how to save income tax refunds.

Last, it also helps to revisit your retirement savings plan when you have important life changes like marriage, the birth of a child, receiving a raise in pay, and changing jobs.

Learn more about handling financial changes as you age

Health Insurance

Medicare is a federal government health insurance program that covers everyone who paid into Social Security during their working years. Most people become eligible for the Medicare program at age 65 and should prepare to sign up for the program as they approach that age to avoid a penalty. You should know that Medicare does not cover all medical costs, so you also need to plan to make co-payments and cover other medical costs while using Medicare.

Long Term Care

The largest uncovered health related costs are due to needing long-term care to help normal daily activities like bathing, dressing, eating, and others. Long term care also includes in-home care, nursing home care or long-term hospitalization. Medicare covers only short stays in nursing care. Some people purchase long-term care insurance, but it can be expensive.

As you plan your retirement, it is best to think about how you might use other things that you own, known as assets, to cover your retirement costs. For example, if you own a home, you may have equity, which is the difference between the amount you owe on the home and the home’s value.

For example, you may have bought a home many years ago for $150,000 and paid down the balance on the mortgage to $50,000. As the mortgage balance has been paid down, the value of the home has increased to $250,000. In this situation, you would have $200,000 in home equity. If you have a financial need during retirement, you may think about using your home equity to pay for your expenses, such as long term care, by selling your home, using a reverse mortgage (click here to learn more about reverse mortgages), or other options.

Wills and Estate Plans

Planning for the end of this life can be an important part of retirement planning. The need to prepare documents like a will (a document that lets you share your wishes about what to do with your property, money, or other possessions after you die) and power of attorney for healthcare form (a form that you complete to give someone else the power to make health care decisions for you if you become very ill) is very important.

The University of Wisconsin – Madison, Division of Extension offers Planning AHEAD, an end-of-life planning curriculum for all ages. This 7-session research-based program will help you understand how to prepare for the end of life for yourself or a loved one, and why it’s important to have a plan in place.

Test your knowledge

Retirement Planning Basics Quiz Take this 10-question quiz to review the basics and test your knowledge. You can take this quiz as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Extension Financial Educator to find out about program requirements.