This module takes about 30-40 minutes to complete. By the end of this module, you will be able to…

- …identify various costs of health insurance such as premiums, deductibles, out-of-pocket maximums and co-pays.

- …determine which health insurance plans fit your individual needs best.

- …know when to seek care from your doctor’s office and when to seek care from urgent care or the hospital.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

A deductible is the amount of money you will need to pay out of your own pocket for health services before your insurance company will pay their share of the costs.

True, it’s important to know the deductible amount when choosing a health insurance plan. Different plans have different deductible amounts.

A health insurance premium is something you only pay when you go see a doctor.

False, you must pay a health insurance premium every month to keep your health insurance plan. It is a monthly fee to give you access to the insurance.

Going to see a doctor is always expensive.

False, some care is free with all health plans, including:

- Yearly check-up

- Well woman check-up

- Screenings and testing

- Immunizations

- Counseling for certain things

But remember, if you bring up other health concerns during your free yearly check-up, you could be billed for treatment for your other concerns.

Learn about health insurance costs:

To get personal help with health insurance, go to Covering Wisconsin. Covering Wisconsin helps Wisconsin residents to connect with health insurance and other programs that support health.

1. You will make a payment every month to keep your health

insurance plan.

This is called a premium. If you don’t pay the monthly premium, you will lose your

health insurance plan.

2. There are 3 stages to using your health insurance during the year:

Your deductible is the money you will need to pay for care before the insurance company starts to pay

its part.

Your out-of-pocket-max (maximum) is the most you will pay in 1 year for covered health services

in addition to the premium.

3. How the deductible and out-of-pocket max works:

Example

Gabriel’s plan has a $1,500 deductible, and a $2,500 out-of-pocket max

For most plans, until you reach your deductible, you pay for all of your medical care.

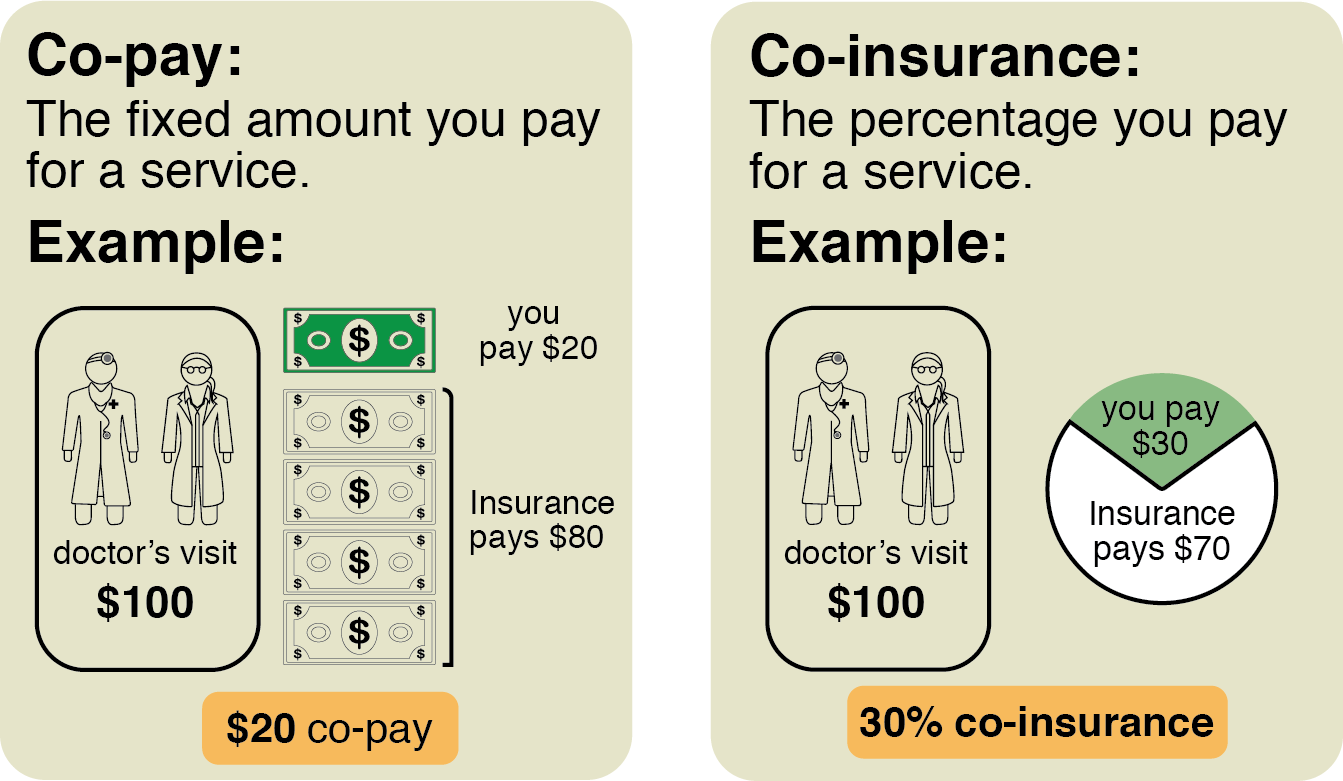

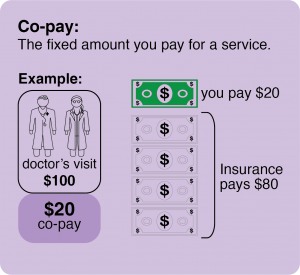

When you go to the doctor, you may be asked for a co-pay. After your visit, you may

receive a bill in the mail for the rest of the charges. Many plans do not count the co-pay

and co-insurance you pay toward the deductible.

Once you have paid enough bills to equal the amount of your deductible then, you

will only pay for the co-pay or co-insurance for all your covered medical services.

Once you have paid enough co-pays, co-insurance, or bills equal to the amount of

the out-of-pocket max, you will not need to pay anything more for the rest of the year.

4. Your possible yearly cost:

Your possible yearly cost is:

12 months of monthly premium payments + the out-of-pocket-max

Example:

Gabriel has a $405 per month premium payment. In 12 months, he will pay $4,860 in

premiums ($405 x 12 = $4,860)

His out-of-pocket max is $2,500. If he uses health care a lot, the most he will likely

pay is $7,360.

Gabriel can save $208 a month to cover his out-of-pocket costs. If he has a medical

emergency he will not have to come up with $2,500 at one time.

More Videos

How to Save Money Using Health Insurance

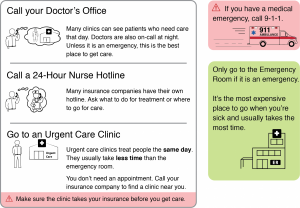

1. Know where to get care when you are sick.

If you have a regular doctor (or primary care provider), it will be easier for you to

get care quickly when you need it most.

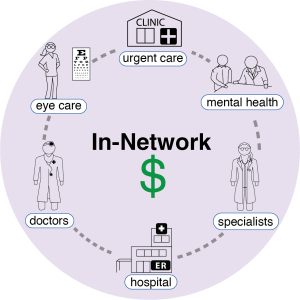

2. Go to doctors, specialists, hospitals and clinics that work with your health plan.

This is called in-network care. Call your insurance company to find a doctor, clinic or hospital near you that is in-network.

You will pay less for care in-network. (Your insurance company has made deals to pay a lower rate with certain doctors, clinics, and hospitals. This saves you money.)

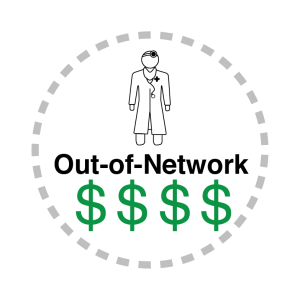

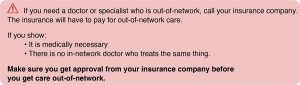

If you get care out-of-network, you will pay more for care.

Some insurance companies or plans will not pay for any care out-of-network. Others will only pay for some of the cost.

3. Use free care that comes with your plan.

There is some care in your plan that has no co-pays or extra costs.

Everyone covered under your health plan gets a free yearly check-up.

Women can also get an additional “well woman” check-up for free.

You can also get some services, shots, and testing for free.

4. Look into ways to get cheaper prescription drugs

The price of your prescription drugs depends on what your health insurance covers,

called a formulary. 4 common tier levels are shown here, some insurance companies have additional tier levels.

If your insurance doesn’t cover a drug you need,

call your insurance company and ask:

- How can I get the prescription drug I need covered.

- How can I file an appeal? An appeal is when you fill out forms to tell the insurance company why they should cover the medicine or service you need.

To save money on prescription drugs:

- Ask your doctor if generic drugs can be used for your health condition.

- Ask your pharmacist if there’s a different drug that is cheaper with your insurance. (You or the pharmacy can contact your doctor about changing the drug.)

- Ask your pharmacist if the company that makes the drug has financial help available. Ask how to apply.

5. Get help if you can’t pay your medical bill

Additional resources or links?

Test your knowledge

Health Insurance Basics Quiz Take this 10-question quiz to review the basics and test your knowledge. You can take this quiz as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Extension Financial Educator to find out about program requirements.