Most Americans are in debt so remember, you are not alone in your journey of debt management. By looking for and accepting support from friends and family, and using the right tools and knowledge, you can navigate your financial situation better. This module will provide you with these necessary tools and knowledge to manage your debt effectively.

This module will take about 15 minutes to complete. By the end of this module, you will be able to:

- …create a complete list of all your debts.

- …choose high-interest debts that you should prioritize paying first.

- …understand different methods of debt consolidation, including credit card balance transfers and credit counseling programs.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

Consolidating your debt means you no longer owe any money.

False, putting all your debts together into one payment might lower your interest rate, but you still owe the money. It just makes it easier to manage.

It’s not necessary to list all your debts, focusing on the big ones is enough.

False, it’s important to write down all your debts, even the small ones. This helps to have a clear picture of your total debt, which is necessary for creating a debt management plan.

You can get rid of your debts simply by managing them well.

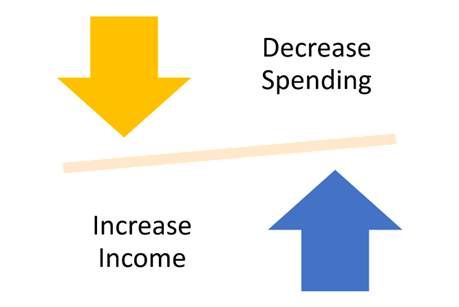

False, at the end of the day, your financial situation is determined by your income and your spending. Finding ways to increase income and decrease spending is essential to paying off debt.

Before talking about how to pay down debt, it is important to note that if you spend more money than you make, it’s hard to pay off debt. While paying off debt, it is also important to work on ways to decrease spending and increase income. These Money Matters modules are designed to help with that:

Now, let’s get started!

- Create a full list of all your debts.

The first step in managing your debt is to have a clear and complete picture of what you owe. You need to write down all your debts, even the little ones. This list should include everything: credit cards, student loans, personal loans, mortgages, car loans, medical bills, and any other debts you might have.

For each debt, note the following:

- Creditor’s name

- Total amount owed

- Interest rate

- Minimum monthly payment

- Due date

By listing all your debts, you can prioritize them and create a plan to pay them off.

Here’s an example of a debt log to give you a template on how to list debts. You can download or print this here:

The PowerPay website has a Debt Reduction Tool that can be used to make a personalized, self-directed debt elimination plan.

- Identify high-interest debt

Once you have a list of all your debts, it’s time to prioritize them. High-interest debts, such as credit cards, often accumulate quickly and can become overwhelming if not addressed. It can be good to prioritize these debts and pay them off first.

An interest rate is the cost of borrowing money, expressed as a percentage. If you borrow $100 from a bank at a 6% interest rate, you need to pay $106 after a year. Usually, interest rates are charged monthly, so your balance would grow roughly 50 cents per month ($6 total for 12 months).

So, if you have credit card debt with an interest rate of 20% and a student loan with an interest rate of 5%, it can be best to pay off the credit card debt first.

- How to consolidate debt

You can combine multiple debts into a single payment with debt consolidation. This makes it easier to manage your debts and may also help lower your overall interest rate.

Credit Counseling Programs: Nonprofit groups offer help to manage your debt and make a plan. They may be able to negotiate lower interest rates and waive fees.

How can you find and get help from a Credit Counseling Program?

You can get started by checking out the Financial Counseling Association of America or (800) 450-1794, and the National Foundation for Credit Counseling or (800) 388-2227. You can also find a list of approved credit counselors through the U.S. Department of Justice List of Approved Credit Counseling Agencies.

A reputable credit counseling agency will send you information about their services for free. If they don’t, that is a red flag and you should look for another agency. More information here: What is Credit Counseling? and here Planning to become debt-free?

Personal Loan: Taking out a personal loan with a lower interest rate to pay off high-interest debts can be another option for debt consolidation. You can use a personal loan to pay off high-interest credit card debt, for example.

Credit Card Balance Transfers: allow you to move debt from high-interest cards to a card with a lower or 0% introductory rate. However, be mindful of balance transfer fees and the interest rate hike after the introductory period.

- Personal bankruptcy and its consequences

Bankruptcy should be considered as a last resort when all other options have been exhausted. It is a viable option only if there is no realistic way for you to pay your biggest debts in years to come. There are two main types of personal bankruptcy:

Chapter 7 Bankruptcy: You sell all your assets (things you own) to pay off as much debt as possible. The bankruptcy will stay on your credit report for 10 years and can make it difficult to get credit, buy a home, or even get a job.

Chapter 13 Bankruptcy: You make a plan to pay off all or part of your debts in 3-5 years. It will stay on your credit report for seven years.

Bankruptcy has long-lasting consequences and should not be taken lightly. However, it is a legal procedure that can offer a fresh start for those who have for example experienced a sharp drop in income. Filing for bankruptcy could cost between $1,500 – $2,000. You need to consult a financial advisor or a bankruptcy attorney first, and you most likely need to hire an attorney for the process.

To get started, contact the Wisconsin Bar Association Lawyer Referrals numbers (608) 257-4666 or 1-800-362-9082.

More information and help regarding personal bankruptcies in Wisconsin here: Bankruptcy – Catholic Charities of the Diocese of Green Bay

More detailed information about personal bankruptcy (Chapter 7 and 13 bankruptcies) here: Bankruptcy Basics

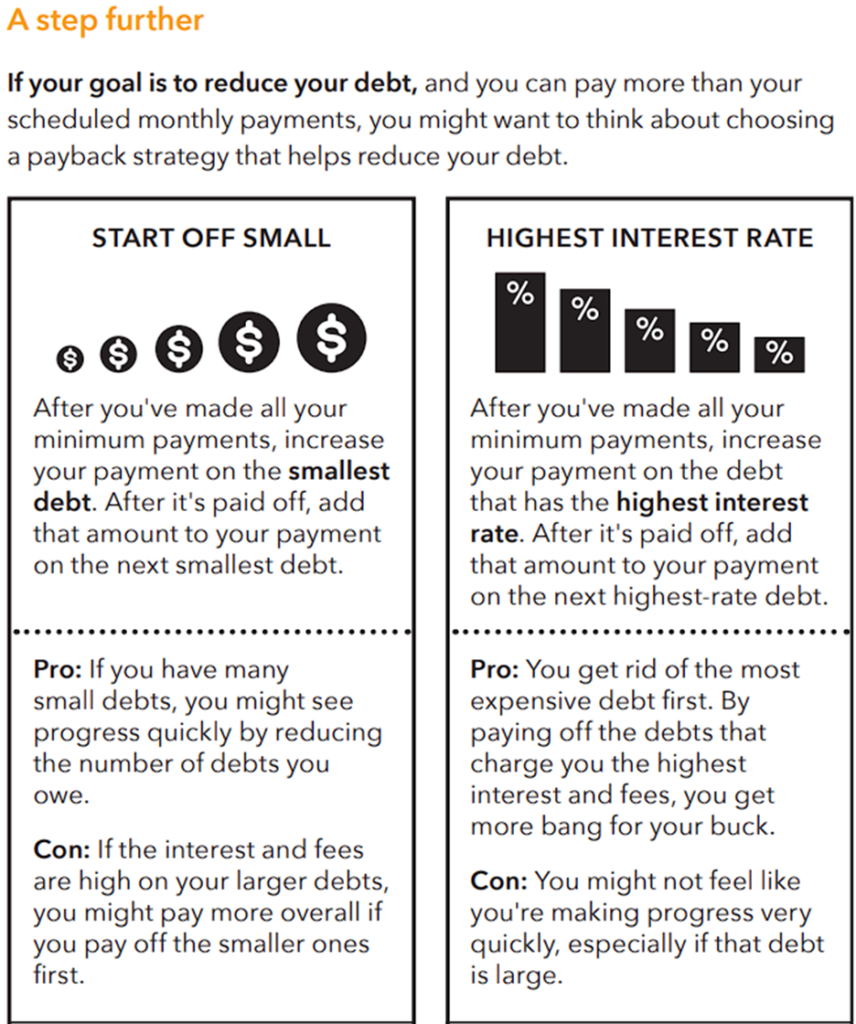

Debt Snowball and Debt Avalanche

These are two popular methods for paying off debt:

- Debt Snowball: You start by paying off the smallest debts first, regardless of the interest rate. The idea is that by paying off smaller debts first, you’ll gain momentum and motivation to tackle the larger ones.

- Debt Avalanche: You start by paying off the debts with the highest interest rate, regardless of the balance. This method will save you more money over time because you’ll pay less in interest.

Both methods have their pros and cons, but they can be helpful depending on what works best for you and your financial situation.

Here’s more discussion about these two debt management strategies:

As you work towards managing and reducing your debt, it’s important to remember the immediate necessities. Don’t forget to pay for important things like rent, food, and utilities. Neglecting these can result in further challenges and complications.

Debt Collection

Debt collection is when companies try to get people to pay back money they owe. There are rules about how they can ask for this money. They can’t call too early or too late, use mean words, lie about the money owed, or threaten things they can’t do. The following video explains more:

More information about debt collection here: Frequently Asked Questions about Debt Collection

Additional Resources

- Debt getting in your way? Get a handle on it.

- Very useful and user-friendly resource about debt management.

Test your knowledge

Debt Management Quiz. Take this 10-question quiz to review the basics and test your knowledge. You can take it as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Madison Extension Financial Educator to find out about program requirements.