This module takes about 15-20 minutes to complete. By the end of this module, you will be able to…

- …identify various costs of health insurance such as premiums, deductibles, out-of-pocket maximums and co-pays.

- …compare health insurance plans.

- …determine which health insurance plans fit your individual needs best.

Complete the following pre-learning check to test your knowledge. Answer “true or false” to the three statements below. Click on the blue box to find the correct answer.

A deductible is the amount of money you will need to pay out of your own pocket for health services before your insurance company will pay their share of the costs.

True, it’s important to know the deductible amount when choosing a health insurance plan. Different plans have different deductible amounts.

A health insurance premium is something you only pay when you go see a doctor.

False, you must pay a health insurance premium every month to keep your health insurance plan. It is a monthly fee to give you access to the insurance.

The out-of-pocket max is the most you will pay for covered health care services in one year.

True, however, you will still need to also pay for your premium every month. If you don’t use your health care during the whole year, you will not have to pay anything more than the monthly premium. Some people who have multiple medical needs may try to squeeze them into 1 calendar year, since the price for all covered services is limited to the out-of-pocket max.

Learn about health insurance costs:

1. You will make a payment every month to keep your health

insurance plan.

This is called a premium. If you don’t pay the monthly premium, you will lose your

health insurance plan.

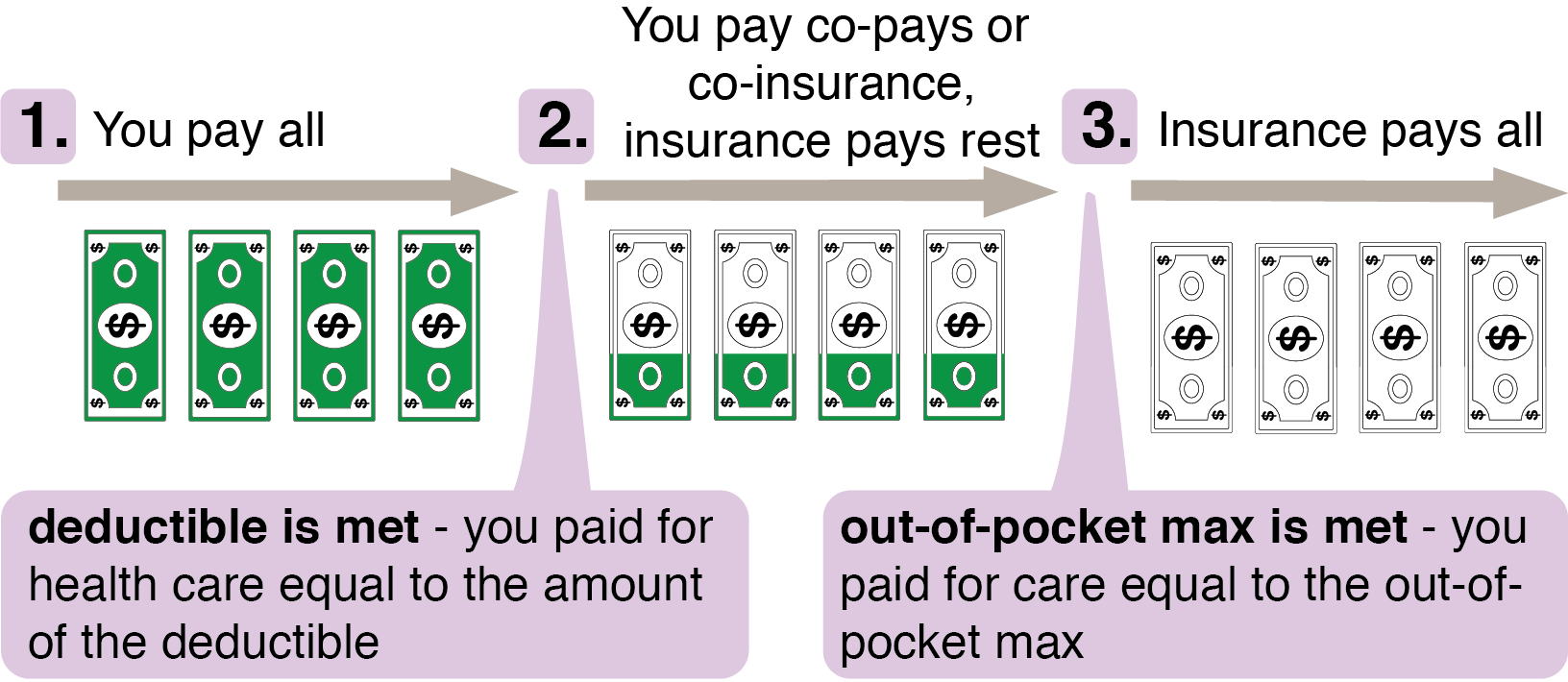

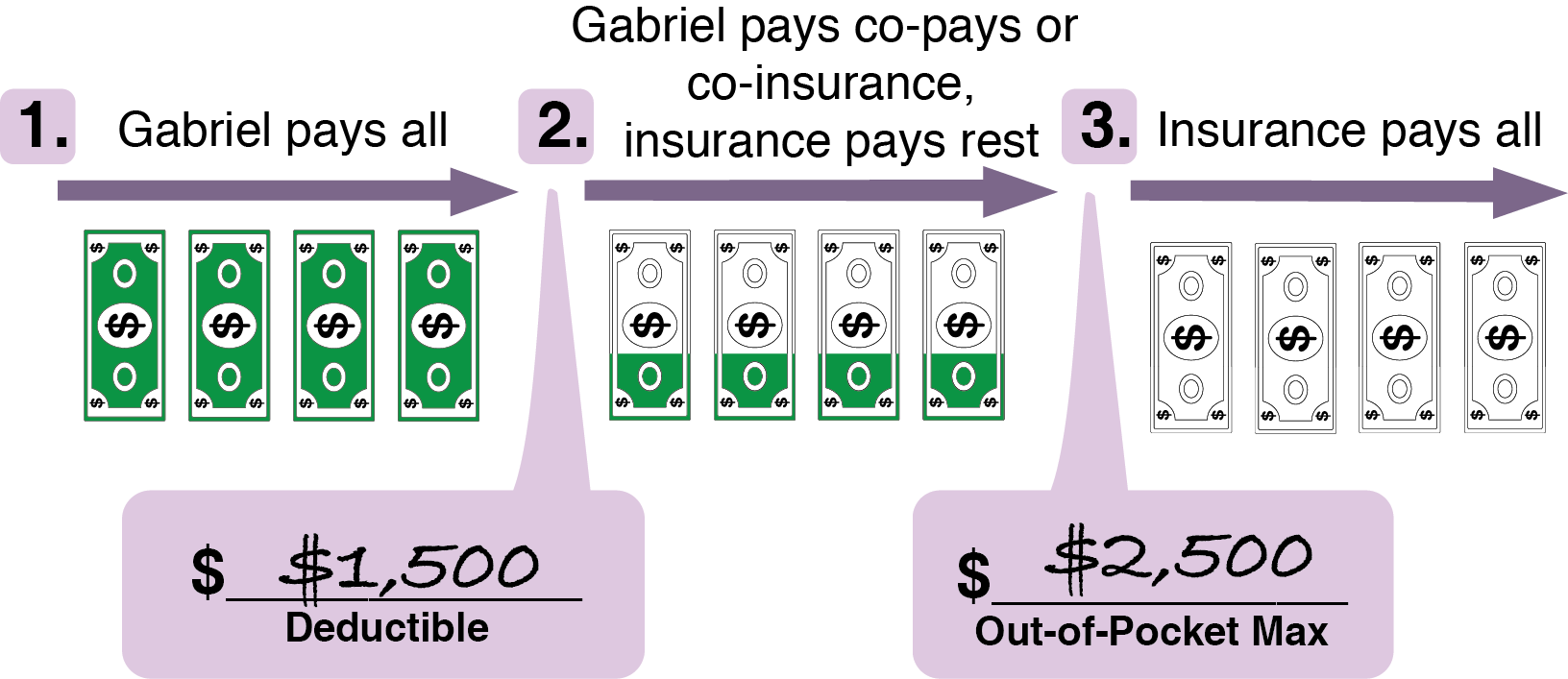

2. There are 3 stages to using your health insurance during the year:

Your deductible is the money you will need to pay for care before the insurance company starts to pay

its part.

Your out-of-pocket-max (maximum) is the most you will pay in 1 year for covered health services

in addition to the premium.

3. How the deductible and out-of-pocket max works:

Example

Gabriel’s plan has a $1,500 deductible, and a $2,500 out-of-pocket max

For most plans, until you reach your deductible, you pay for all of your medical care.

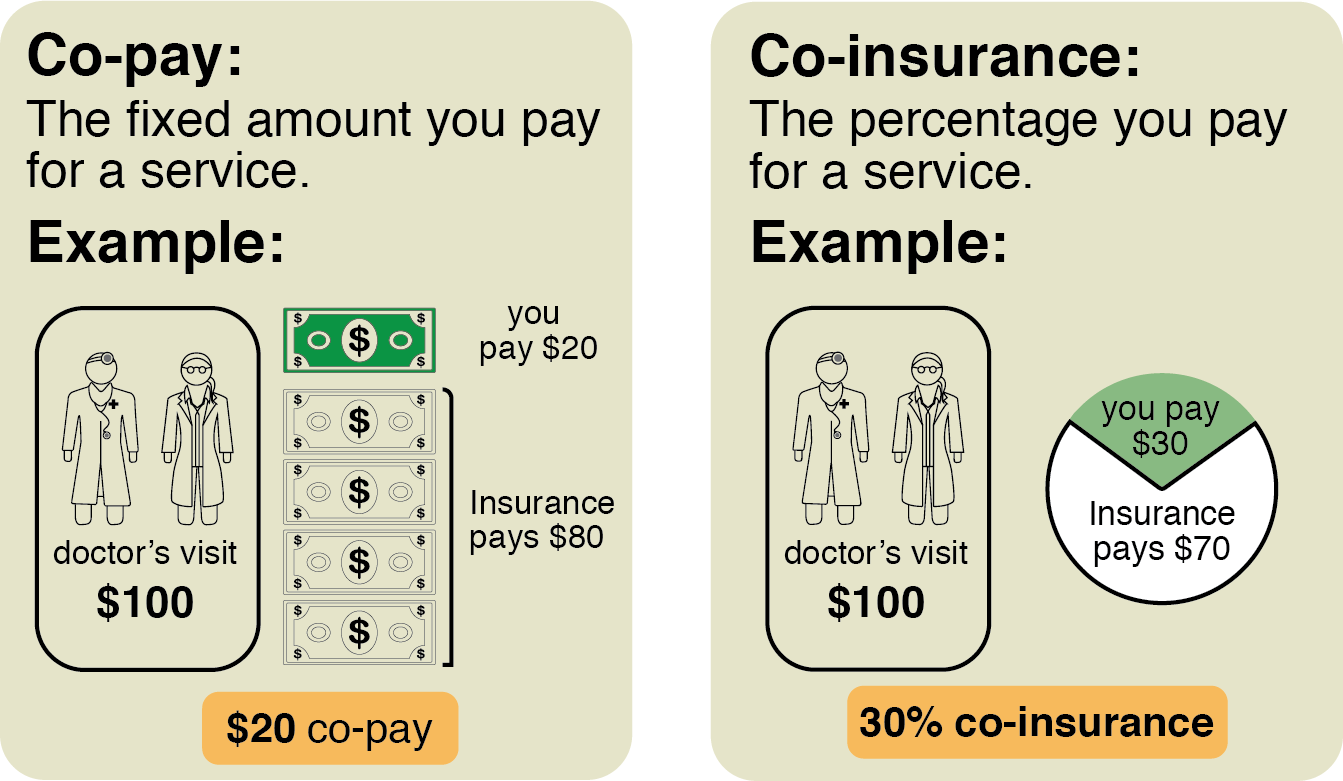

When you go to the doctor, you may be asked for a co-pay. After your visit, you may

receive a bill in the mail for the rest of the charges. Many plans do not count the co-pay

and co-insurance you pay toward the deductible.

Once you have paid enough bills to equal the amount of your deductible then, you

will only pay for the co-pay or co-insurance for all your covered medical services.

Once you have paid enough co-pays, co-insurance, or bills equal to the amount of

the out-of-pocket max, you will not need to pay anything more for the rest of the year.

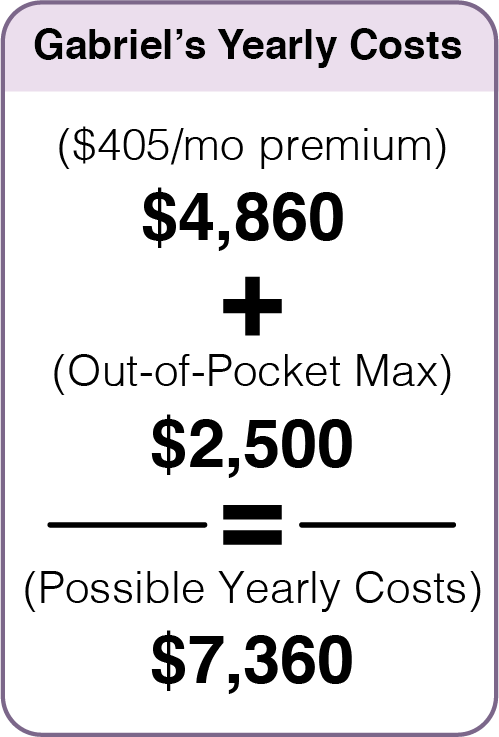

4. Your possible yearly cost:

Your possible yearly cost is:

12 months of monthly premium payments + the out-of-pocket-max

Example:

Gabriel has a $405 per month premium payment. In 12 months, he will pay $4,860 in

premiums ($405 x 12 = $4,860)

His out-of-pocket max is $2,500. If he uses health care a lot, the most he will likely

pay is $7,360.

Gabriel can save $208 a month to cover his out-of-pocket costs. If he has a medical

emergency he will not have to come up with $2,500 at one time.

More Videos

Test your knowledge

How Health Insurance Works Quiz Take this 10-question quiz to review the basics and test your knowledge. You can take this quiz as many times as you want.

Certificate of Completion

If you’d like to certify that you’ve completed this module, be sure to contact a UW-Extension Financial Educator to find out about program requirements.